User activity on finance apps has rocketed by 354 55 4 million millennial s aged 23 38 will use digital banking in 2019 with almost 40 of this demographic totally abandoning brick and mortar banks altogether 64 of millennial s have at least one full service banking app on their phone as well as 59 of gen xers and 41 of people aged 55 according to bankrate.

Algorithmic trading software open source india.

A trading algorithm is a step by step set of instructions that will guide buy and sell orders.

To learn about different trading strategies.

Rs 7080 rupees seven thousand and eight only.

Algotrader ag partners with enigma securities providing better solutions for institutional investors.

To learn about algorithmic trading and its audit and compliance process.

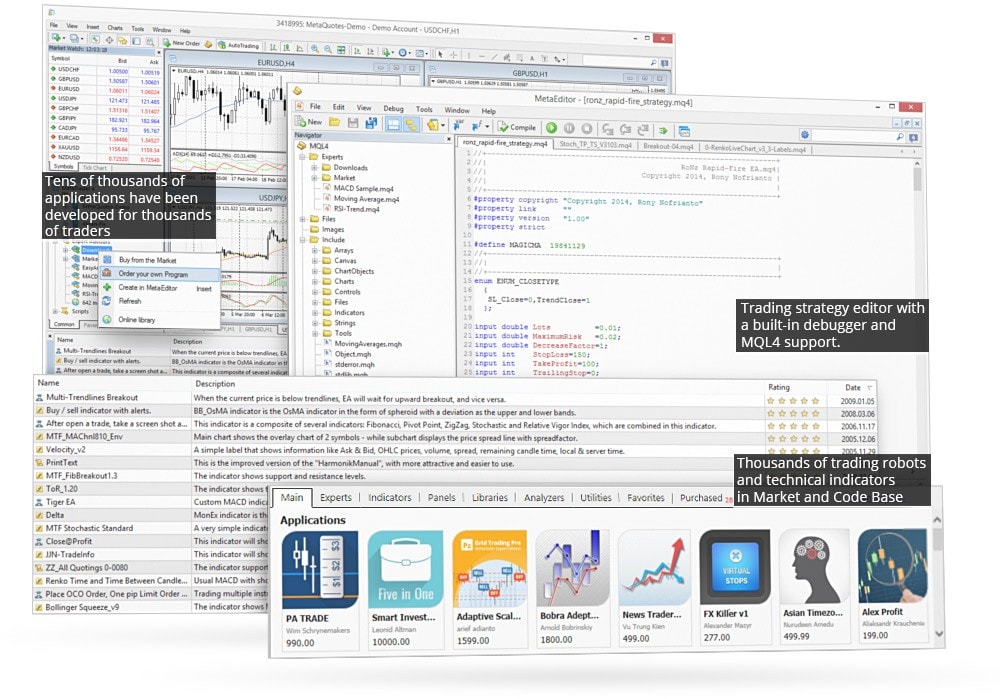

Wrapper library for algorithmic trading in python 3 providing dma stp access to darwinex liquidity via a zeromq enabled metatrader bridge ea.

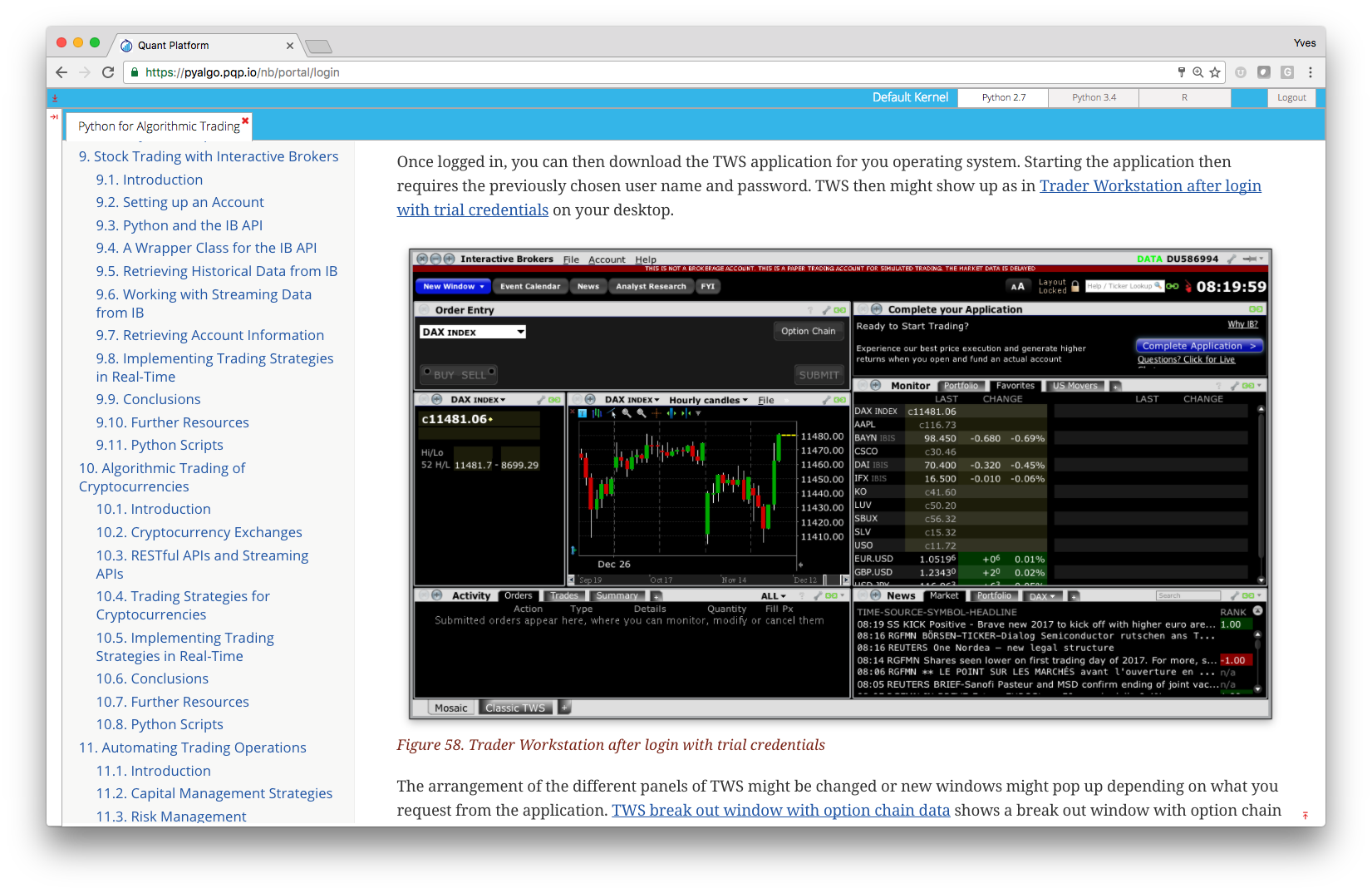

Picking the correct software is essential in developing an algorithmic trading system.

This can be considered as the arrival of algorithmic trading at in india.

To devote its research and technology to creating strategies that contribute wealth to our life.

To learn risk management in algorithmic trading.

Algorithmic trading in india.

Algo trader is the first fully integrated algorithmic trading software solution for hedge funds and trading companies and also a first algorithmic trading software product to allow automated trading of bitcoin and other crypto currencies.

Paperbroker 153 an open source simulated options brokerage and ui for paper trading algorithmic interfaces and backtesting.

Furthermore since this was introduced during the global recession the entire banking and the securities market was rallied by the introduction of dma.

Algo profits follow a simple business philosophy.

It enhances automation of complex quantitative trading strategies in equities forex and derivative.

To achieve this we set high standards on our performance and.

Algo profits is a leader in development of high quality algorithmic trading systems for the retail trader and enterprise level clients.

Furthermore algorithmic trading is no longer solely the turf of institutional traders brokers and large fund houses.

Course fees total fees.

Past present and future.

:max_bytes(150000):strip_icc()/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)